Market Overview

The U.S. stock market experienced a challenging trading day. Major indices closed significantly lower. Investor sentiment remained cautious throughout. Negative headlines dominated trading activity.

Major Indices

U.S. stock market performance concluded poorly. All three major indices recorded declines.

- S&P 500 Index: Closed at 5,939.31. This represented a 0.53% decrease. The index reached 5,999 intraday. However, profit-taking emerged late. This pushed prices lower by day’s end.

- Nasdaq Composite Index: Ended at 19,298.45. It saw a notable 0.83% drop. Tesla’s significant decline weighed heavily. NVIDIA also lacked upward momentum. Technology stocks faced broad pressure.

- Dow Jones Industrial Average: Finished at 42,319.74. This was a 0.25% reduction. The Dow showed early weakness. It attempted to rebound midday. However, selling pressure increased later.

Overall, all three benchmarks posted negative closes. This signaled a tough day for equities.

Key Market Trends & News

Several factors influenced market performance. A mix of economic data and political events shaped the day.

Rising U.S. Jobless Claims:

U.S. jobless claims increased. New unemployment claims rose by 8,000. The total reached 247,000 filings. This figure exceeded forecasts of 235,000. It signals potential labor market weakness. The four-week moving average also rose. This indicates a weakening trend. Continuing claims were 1.904 million. This number remains elevated. Analysts view this as concerning. It suggests economic softening.

Non-Farm Productivity Declines:

First-quarter non-farm productivity decreased.2 It fell by 1.5%. This follows previous weakness. The decline was steeper than expected. This further fueled recession fears.

Corporate Layoff Announcements:

Numerous companies announced layoffs. This indicates a contraction in business activity.

- Procter & Gamble plans 7,000 job cuts.

- Microsoft confirmed 6,000 layoffs.

- Citi recently cut 3,500 positions.

- Walmart, Klarna, Cloudstrike, and Disney are also reducing staff.

- Chegg, Amazon, and Warner Bros. likewise announced workforce reductions. These widespread cuts suggest economic uncertainty. They raise concerns about future growth.

U.S. Trade Deficit Narrows Significantly:

The U.S. trade deficit decreased. It reached 61.6 billion dollars. This marks a substantial reduction. The figure is roughly half of March’s deficit. It is the lowest since September 2023. This could imply some tariff policy success. However, it also suggests reduced import demand.

Trump-Musk Feud Impacts Market:

A public spat between Donald Trump and Elon Musk escalated.4 This significantly impacted market sentiment. Musk criticized a new U.S. budget bill.5 He called it an “abomination.” Trump responded aggressively. He stated disappointment in Musk. Trump threatened to revoke government subsidies.6 This includes electric vehicle credits. He also mentioned SpaceX contracts. Trump cited an “easy way to save billions.” Musk retorted sharply online. He claimed Trump would have lost the election without him. He suggested a new political party. This public feud created considerable market volatility. It especially affected Tesla’s stock.

Eurozone Interest Rate Cut:

The European Central Bank cut interest rates.7 This decision lowered borrowing costs. ECB President Christine Lagarde spoke positively. She indicated higher growth forecasts. This action influenced global bond markets. It caused a slight rise in U.S. bond yields.

Interest Rates & Bond Market

Interest rates saw slight upward movement. The 10-year U.S. Treasury yield increased. It rose by 3 basis points. This brought it to 4.395%. The 2-year yield also moved up. It climbed by 5 basis points. This reflected market adjustments. The euro zone rate cut impacted U.S. bonds. It exerted some upward pressure on yields.

Commodities Market

Commodity prices exhibited mixed trends.

- Gold: Gold futures fell. They declined by 0.59%. The price settled at $3,379.2 per troy ounce.

- Oil (WTI): Crude oil prices rose. They increased by 0.8%. A barrel reached $63. This indicates a rebound.

Major Tech Stocks Performance

Major technology stocks experienced varied performance.

- Tesla (TSLA): Plunged by 14.28%. This was due to the Trump-Musk feud. After-hours trading saw further declines. The stock traded near $282. It lost significant market capitalization. Tesla fell out of the $1 trillion club. Its market cap is now $917 billion.

- Microsoft (MSFT): Rose by 0.82%. It reclaimed its top market capitalization spot. Its valuation is $3.4 trillion.

- NVIDIA (NVDA): Fell by 3.6%. It lost recent gains. Despite positive news, it declined. Nintendo Switch 2 using NVIDIA chips is a benefit. Amazon AWS cutting GPU prices is also good. NVIDIA’s market cap moved to second.

- Apple (AAPL): Declined by 1%. Reports of unfavorable news affected it. This includes concerns about China. External payment systems were also a factor. A court ruling on Epic Games influenced this. Apple’s EPS could drop 2-3%.

- Alphabet (GOOGL): Saw a slight increase. CEO Sundar Pichai discussed AI’s evolution. He stressed engineering importance. This suggested stable staffing levels.

- Palantir (PLTR): Dropped by 7%. Data privacy concerns contributed. Federal contracts were positive. However, surveillance issues weighed on shares.

- Broadcom (AVGO): Traded lower after hours. It showed a 2.83% decline. Despite strong earnings, it faced pressure. Revenue reached $15 billion. AI segment grew 46%. Q3 guidance was positive.

- DocuSign (DOCU): Fell 15% after hours. Earnings beat estimates. Yet, the stock experienced a significant drop. No clear reason for the decline emerged immediately.

- Uber (UBER): Gained 1.46%. CEO hinted at stablecoin usage. This could reduce currency exchange losses.

- Circle Internet (USDC): Debuted with strong gains. It rose 169% above its offering price. It briefly touched $95. This stablecoin issuer had a historic IPO.

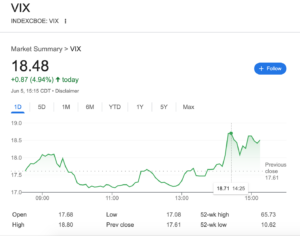

Market Sentiment & Flows

Market sentiment was predominantly cautious. The “Fear & Greed Index” moved to 59. This is in the “Greed” zone. However, underlying anxiety remained. Investor focus was on upcoming data. Declining stocks outnumbered advancers. Around 3,450 stocks fell. Only 2,785 stocks rose. This suggests a broad market downturn. Retail and cyclical stocks performed better. Summer shopping trends provided some support.

Upcoming Key Economic Indicators & Events

Market participants await key economic data.

- U.S. Non-Farm Payrolls Report: Scheduled for Friday. This is a critical indicator. It will provide more clarity. Labor market health will be assessed.

- Unemployment Rate: Also due Friday. Economists project 4.2%.

These reports will offer insights. They may dictate short-term market direction.

Conclusion & Market Outlook

The U.S. stock market faced a challenging day. Key factors included rising unemployment claims. Corporate layoff announcements further dampened sentiment. The escalating Trump-Musk feud significantly impacted Tesla. This dragged down broader indices. Despite some positive developments, caution prevailed. Investors are now keenly focused. Upcoming employment data will be crucial. This data will shape future expectations. It will influence monetary policy decisions. The market remains at a pivotal point. It balances between soft landing hopes and recession fears.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making investment decisions.