Tesla’s stock saw recent fluctuations. The company’s future remains a key focus. Investors watch for new developments.

Recent Stock Movements and Trends

Tesla stock rose 2.64% in five days. This past week showed good gains. The stock started strong on Monday. It reached nearly $365. However, it dipped slightly on Friday. This reflected broader market trends.

Weekly Performance: Tesla closed the week strong. It rose 1.59%. This positive trend followed a good month. May ended well for Tesla. Many tech stocks performed strongly too. This includes Nvidia and Microsoft. Broadcom, Amazon, and Meta also saw gains.

Longer-Term View: Tesla’s stock started the year around $400. It is now at $346. This represents a 14.21% decline from its yearly high. Despite this, Tesla has recovered significantly. The stock has shown good upward momentum. This started around April 19th. It has climbed steadily for about 40 days.

Technical Indicators: The stock reached Bollinger Band upper limits. It has since pulled back slightly. It remains above its 15-day moving average. This average is $336. The 5-day average was briefly broken. However, the overall upward trend is intact. The Relative Strength Index (RSI) is 61. It is now easing from overbought conditions. Volume increased last Friday. It hit 120 million shares.

Investor Sentiment and Key Price Levels

Average investor holding price is $296. Many bought between $250 and $300. Significant buying also occurred between $340 and $360. This indicates strong buyer interest.

Financial Health and Risk Factors

- Valuation: Tesla’s Price-to-Earnings (P/E) ratio is high. It stands at 190. Projections suggest a drop to 116 next year. Earnings Per Share (EPS) should rise significantly. It is expected to increase by 50% next year.

- Risk Metrics: The beta for Tesla is 2.49. This indicates higher volatility. The RSI is currently 61.29.

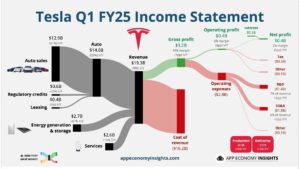

- Profit Margins: The company’s gross margin is 17.6%. Operating margin is 7.4%.

Short Interest and Insider Activity

- Short Selling: Short interest increased significantly. It reached 63.8% last Friday. Some believe short selling may have peaked.

- Insider Trading: No special insider trades this week. However, a director recently sold shares. This director sold 477,000 shares at $357. Kimball Musk previously sold 91,000 shares. This indicates insiders are realizing profits.

Major News and Strategic Shifts

Elon Musk’s Departure from Government Council: Elon Musk officially left the government efficiency council. This news broke last Friday. It was widely anticipated since April. His departure is seen positively. It allows him to focus more on Tesla. Analysts hope for increased dedication.

Analyst Price Target Revisions: Average price targets are rising. The average is now $293.

- Dan Ives (Wedbush): Raised target to $500. This is up from $350. Ives maintains a bullish outlook.

- Other Targets: Mizuho raised its target to $390. Piper Sandler moved to $400. Arcus Research is at $410. Stifel Nicolaus sees $450 by year-end.

- Adam Jonas (Morgan Stanley): Maintained his $410 target. He kept a “buy” rating. However, he warned against excessive excitement. This specifically relates to the upcoming robotaxi launch.

Robotaxi (Cybercab) Launch: The launch is set for June 12th. Bloomberg reports this date. Initial operations will be limited. Around 10-20units may operate. These will be in specific areas. Adam Jonas urges tempered expectations. Detailed information is still pending. Tesla’s CEO, Elon Musk, stated positive test results. The robotaxis operated without incidents for days. This launch is ahead of schedule. The current model for robotaxi use is the Model Y Juniper. It features cameras and lidar.

Gary Black’s Position Exit: Gary Black, a prominent Tesla bull, sold his entire position. He cited high P/E ratios. Black believes fundamentals are disconnected. His target was $310. He may buy back if prices drop.

Ark Invest’s Profit Taking: Cathie Wood’s Ark Invest sold Tesla shares. This occurred on May 27th, 28th, and 30th. They sold 27,377, 15,817, and 6,500 shares respectively. Ark typically maintains a 10% Tesla weighting. This selling reflects profit-taking. News surrounding the robotaxi and Musk’s focus fueled the rally.

Operational Performance and Market Challenges

Revenue Breakdown: Tesla’s last reportedrevenue was $19.3 billion. Automotive sales contributed $14 billion. Energy revenue was $2.7 billion. This is up 67% year-over-year. Services revenue reached $2.6 billion. This includes Supercharger related income. Supercharger revenue rose 15%. Automotive sales must sustain growth. This is crucial until new ventures mature. These include robotaxis and Optimus. Adam Jonas has lower expectations for automotive growth.

China Market: China insurance registrations are strong. Weekly registrations are around 11,000 units. Total registrations are 59,000 this quarter. This matches Q1 performance. Model 3 sales are 3,600 units. Model Y sales are 7,400 units. The new Model Y performs well. Competition is fierce in China. BYD is a strong competitor. Xiaomi is gaining ground quickly. Xiaomi sold 28,000 units in May. Tesla sold approximately 30,000 units. Tesla faces increasing pressure here.

European Market: European sales show weakness. April sales in Europe fell 49%. UK sales increased in April. The UK is removing Tesla taxes. This offers some relief.

Supercharger Network Issues: New Jersey Turnpike Superchargers faced issues. 64 Supercharger stalls were unavailable. New Jersey selected a different charging provider. This affects a critical travel route. It likely impacted Friday’s stock price. However, alternative charging exists off-highway. The LA Diner and Supercharger complex is complete. This offers charging, dining, and entertainment.

Future Outlook and Headwinds

Upcoming Catalysts: The robotaxi launch is a major catalyst. Optimus, the humanoid robot, is also highly anticipated. It could launch by year-end. Fremont factory production of Optimus is planned. Cybercab and Semi-trucks are also on the horizon.

Geopolitical Concerns: US-China trade tensions persist. Geneva agreements are stalled. Tariffs on Chinese goods rose by 50%. This could impact Tesla’s global operations.

Robotaxi Progress: Robotaxi development is progressing. Elon Musk confirmed successful, accident-free trials. They are operating in limited areas. This is ahead of schedule by a month. The Model Y Juniper will be used. It has cameras and lidar.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making investment decisions.