MarketOverview

The U.S. stock market saw a significant rebound this past week. Despite early fluctuations, positive economic indicators fueled a strong finish. Investor confidence showed signs of returning, especially as key uncertainties began to subside.

Major Indices

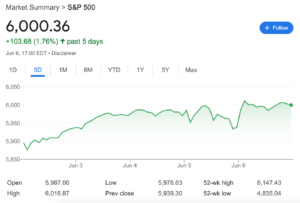

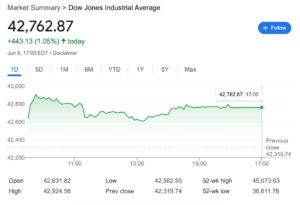

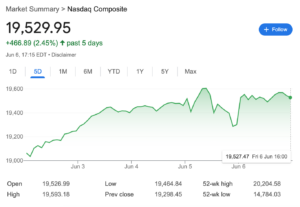

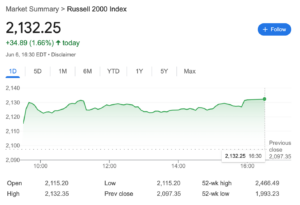

All major U.S. stock market indices experienced gains. This broad-based rally indicates a positive shift in market sentiment.

- The S&P 500 surged 2.14%, finally closing above 6,000.

- The Dow Jones climbed 1.96%, adding 820 points to reach 42,793.

- The Nasdaq Composite also rose significantly, gaining 2.59% weekly.

- The Russell 2000, representing smaller companies, jumped an impressive 4.12%.

Key Market Trends & News

Several crucial developments influenced market trends this week. These factors contributed to the overall positive market momentum.

Trade Relations and Tariffs

Initially, trade tensions caused market jitters. However, recent developments brought some relief to investors.

- U.S.-China dialogue improved with a direct phone call between leaders. This eases concerns about escalating trade wars.

- While tariffs still loom, a July 9 deadline provides some temporary clarity.

- Tariff uncertainties remain, but initial steps toward dialogue are positive.

- Similarly, tariffs on European Union goods were also postponed until July 9.

Political & Business Figures

High-profile interactions sometimes influence market dynamics. This week saw a cooling of a notable public dispute.

- The public spat between Donald Trump and Elon Musk appears to have subsided.

- Musk has ceased his social media attacks, and Trump’s tone has softened.

- Despite past threats, Trump emphasized fairness in future dealings.

- This de-escalation helped stabilize related stock prices.

Economic Indicators

Recent economic data offered a clearer picture of the U.S. economy’s health. Many indicators suggest a resilient, albeit slowing, economy.

- May’s jobs report surpassed expectations, showing over 130,000 new jobs. This indicates the economy is not yet in recession.

- The unemployment rate held steady at 4.2%, avoiding a critical threshold.

- ISM Manufacturing PMI remains below 50, indicati

- ng contraction in manufacturing. However, this sector is a small part of the U.S. GDP.

- The ISM Services PMI landed at 49.9, signaling slight contraction. Still, this is not indicative of a deep recession.

- Consumer confidence remains robust, with the index at 98. A reading below 80 typically signals recession.

- Leading economic indicators do not yet point to an impending recession.

- GDP growth is projected at 1.6% for the current period, remaining positive.

- Personal income rose 0.8%, and consumer spending increased by 0.2%. These figures support ongoing economic activity.

- Core inflation has not significantly risen due to current tariff levels. Overall, headline inflation is near the Fed’s 2% target.

Interest Rates & Bond Market

The Federal Reserve’s stance and bond yields are critical for investors. Current expectations align with market’s recent upward trend.

- The Fed is likely to hold rates, not anticipating an immediate recession.

- Market participants expect two rate cuts by year-end, driving stock gains.

- The 2-year Treasury yield reflects these anticipated rate cuts.

- The 10-year Treasury yield rose to 4.5%, signaling a stronger economy.

- Higher bond yields can create a headwind for equity markets.

- The 30-year Treasury yield is nearing 5%, also reflecting economic strength.

- The Fed’s June FOMC meeting and new economic projections are crucial. These will offer more insights into future rate decisions.

Market Sentiment & Flows

Investor sentiment has visibly improved, boosting market performance. Capital is flowing back into equity markets.

- The Fear & Greed Index moved from neutral to 63, indicating growing optimism.

- This shift suggests a reduction in market fear among investors.

- The VIX Index (volatility index) dropped to 16.7, confirming lower anxiety.

- S&P 500 forward P/E ratio is at 6,000, aligning with Goldman Sachs’ target.

- Some analysts now project the S&P 500 could reach 6,500.

- The S&P 500’s RSI (Relative Strength Index) suggests room for further upside.

- The Nasdaq’s RSI also indicates potential for additional gains.

- The U.S. Dollar Index stabilized at 99.14, reinforcing market confidence.

- The Japanese Yen weakened against the dollar, reaching 144.87. This mitigates Yen carry trade concerns.

- Money Market Funds hold substantial cash, over 7 trillion dollars. This significant liquidity can flow into equities, supporting the market.

- M2 money supply continues to increase, reflecting strong investor purchasing power.

Major Tech Stocks Performance

Leading technology stocks showed strong performance this week. Many experienced notable gains as market sentiment improved.

- Meta Platforms rose 7%, demonstrating robust investor confidence.

- Amazon gained 4%, reflecting strong e-commerce and cloud demand.

- Nvidia saw a 4.8% increase, driven by sustained AI enthusiasm.

- Microsoft climbed nearly 2%, indicating solid underlying business strength.

- Apple also rose nearly 2%, benefiting from broader market uplift.

- Eli Lilly (pharmaceutical) jumped 4%, leading a strong pharma sector.

- Moderna gained 2.77%, with healthcare stocks broadly performing well.

However, some key tech names faced challenges year-to-date.

- Apple is down 18% year-to-date, possibly impacted by trade concerns.

- Tesla has dropped 26% year-to-date, facing multiple headwinds.

- Google is down 8% year-to-date, showing slower growth.

- Amazon is down 2% year-to-date, still recovering from previous peaks.

- Palantir showed some weakness this week, despite overall market gains.

Upcoming Key Economic Indicators & Events

The coming weeks hold several important economic releases and events. These will provide further direction for the market.

- Apple’s WWDC (Worldwide Developers Conference) runs June 9-13. Investors anticipate new AI announcements from Apple.

- Oracle’s earnings report is expected soon, focusing on cloud performance. Strong results could boost the cloud computing sector.

- Tesla’s robotaxi launch on June 12 is highly anticipated. This could significantly impact the autonomous driving sector.

- CPI (Consumer Price Index) data for May is due next week. A potential rise in core CPI to 2.9% could impact inflation expectations.

- Federal Reserve’s FOMC meeting is scheduled for June 18. The dot plot and economic projections will be closely watched.

- Quadruple Witching Day on June 20 will likely increase market volatility.

- U.S. debt ceiling discussions and tax reform bills could resurface in late June/early July. These issues historically create market uncertainty.

Conclusion & Market Outlook

The U.S. stock market delivered a strong performance this week. Reduced trade tensions and positive job data fueled the rally. Investor sentiment has improved significantly.

However, caution is still warranted. Inflationary pressures from rising labor costs could push bond yields higher. Geopolitical events and upcoming economic data releases will continue to shape the market. The short-term outlook suggests continued positive momentum. However, investors should remain vigilant for potential shifts later in June and July. Key events like the FOMC meeting and future tariff decisions could introduce new volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making investment decisions.