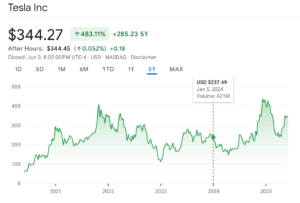

Tesla (TSLA) Investment Strategy Comparison: A $10,000 Portfolio Analysis

This detailed analysis compares two distinct investment approaches for Tesla (TSLA) stock. Both scenarios utilize a $10,000 initial investment budget. We evaluate their performance over specific periods. This analysis is based on actual historical monthly closing prices. Data was extracted directly from your provided image. Understanding these strategies offers crucial investment insights.

1. Scenario 1: $10,000 Lump-Sum Investment (January 2, 2024 Purchase)

This strategy involved a single, upfront capital deployment. The entire $10,000 was invested at once. This occurred on January 2, 2024. The closing price that day was $248.48 per share. Consequently, 40.2455 shares of TSLA were acquired. This represents the maximum possible purchase. All funds were committed instantly.

Performance Evaluation by Month-End:

We track the portfolio’s value at key checkpoints. These include the end of December 2024, March 2025, and May 2025.

- As of December 2024 End (Closing Price: $403.84)

- Current Portfolio Value: $16,249.49

- Profit/Loss: $6,249.49 Gain

- Return on Investment (ROI): +62.49%

- Analysis: The initial investment saw significant growth. This period experienced a strong upward trend. Tesla’s stock price appreciated considerably. This demonstrated the potential of lump-sum investing. Early entry into a rising market yields substantial capital gains.

- As of March 2025 End (Closing Price: $259.16)

- Current Portfolio Value: $10,430.79

- Profit/Loss: $430.79 Gain

- Return on Investment (ROI): +4.31%

- Analysis: The portfolio experienced a sharp decline. This reflects a significant market correction. Tesla’s stock price dropped considerably from its late 2024 highs. Despite the drop, the investment maintained a positive return. Initial strong gains provided a buffer against this downturn. However, the profit margin shrank dramatically.

- As of May 2025 End (Closing Price: $346.46)

- Current Portfolio Value: $13,944.47

- Profit/Loss: $3,944.47 Gain

- Return on Investment (ROI): +39.44%

- Analysis: The market rebounded in this period. Tesla’s stock price recovered significantly. Consequently, the portfolio’s value increased again. This illustrates market recovery potential. It also shows the importance of long-term holding. Recovering from a dip contributes to overall profitability.

Summary of Lump-Sum Strategy:

This approach offers simplicity. It maximizes exposure to initial market movements. In a strong bull market, it can yield high returns. However, it carries substantial risk. Poor timing can lead to immediate losses. The strategy lacks protection against market downturns. Volatility can severely impact short-term performance.

2. Scenario 2: Monthly 10-Share Purchase (Within $10,000 Limit)

This strategy adopts a dollar-cost averaging approach. Investors purchase 10 shares each month. This continues until the $10,000 budget is exhausted. The strategy commenced in January 2024.

Investment Budget Depletion:

The $10,000 investment limit was reached in June 2024. By this month, the budget was largely utilized. A total of 53 shares were acquired. The total cost incurred was $9,856.84. The average purchase price for these shares was $185.98. The final purchase in June only involved 3 shares. This allowed staying within the budget.

Performance Evaluation by Month-End (for the 53 acquired shares):

We evaluate the portfolio’s value monthly. This starts from December 2024. The 53 shares are held throughout.

- As of December 2024 End (Closing Price: $403.84)

- Current Portfolio Value: $21,303.52

- Profit/Loss: $11,446.68 Gain

- Return on Investment (ROI): +116.13%

- Analysis: This period shows exceptional performance. The portfolio generated significant profits. The strategy successfully captured market upside. All 53 shares contributed to this growth. This demonstrates the power of consistent accumulation.

- As of January 2025 End (Closing Price: $404.60)

- Current Portfolio Value: $21,343.80

- Profit/Loss: $11,486.96 Gain

- Return on Investment (ROI): +116.54%

- Analysis: The strong performance continued. Slight appreciation was observed. This extended the impressive gains from the previous period. The portfolio maintained its high value.

- As of March 2025 End (Closing Price: $259.16)

- Current Portfolio Value: $13,735.48

- Profit/Loss: $3,878.64 Gain

- Return on Investment (ROI): +39.35%

- Analysis: The market downturn persisted. Profit margins narrowed further. Despite this, the investment remained profitable. Dollar-cost averaging helped manage the average purchase price. This softened the impact of the decline.

- As of May 2025 End (Closing Price: $346.46)

-

- Current Portfolio Value: $18,362.38

- Profit/Loss: $8,505.54 Gain

- Return on Investment (ROI): +86.29%

- Analysis: The recovery continued strongly. The portfolio regained substantial value. This period ended with an excellent return. This reinforced the strategy’s resilience.

Summary of Monthly Purchase Strategy:

This method allows for disciplined investing. It mitigates market timing risk. Buying at various price points smooths out the average cost. This approach can be particularly beneficial. It excels during volatile or declining markets. It allows investors to accumulate more shares. This happens when prices are lower.

Overall Comparison and Key Investment Insights

Both investment scenarios for Tesla (TSLA) demonstrated positive returns. This occurred during the analyzed period. However, their performance trajectories and underlying dynamics differed.

Impact of Market Fluctuations:

The period from January 2024 to May 2025 showed significant market volatility. Tesla’s stock experienced a robust rally through late 2024. Subsequently, it faced a sharp decline in early 2025. Finally, a strong rebound occurred by May 2025. Both strategies navigated these shifts.

Strategy Effectiveness:

Key Takeaways:

- Capital Allocation: The monthly purchase strategy, by deploying capital over time, secured more shares (53 shares) within the $10,000 budget. This larger share count, once acquired, amplified returns during subsequent price increases.

- Risk Management: Dollar-cost averaging serves as a powerful risk management tool. It smooths out market entry points. This strategy potentially leads to less severe drawdowns. It also facilitates quicker recovery during volatile periods.

- Flexibility: For investors uncertain about market timing, regular smaller investments offer a flexible approach. They avoid the “all-in” risk of lump-sum investing.

Conclusion:

Both investment strategies proved profitable for Tesla stock in this specific timeframe. However, the monthly purchase strategy (dollar-cost averaging), by consistently accumulating shares within the budget, demonstrated a more robust and resilient performance during periods of market volatility. It achieved a higher absolute profit amount by May 2025. This underscores the benefits of systematic investment over time. It can potentially outperform lump-sum investing in fluctuating markets.

Disclaimer: This content is for informational purposes only. It does not constitute financial advice. Investment decisions should be made with a qualified financial advisor. Past performance is not indicative of future results. Market conditions can change rapidly.